We develop real estate. We understand the construction trade. And we think and act with a long-term perspective as owners of large buildings and sites in Switzerland’s urban centres.

Our mission statement

Real estate shapes public space. We live and work in it. Often for decades. When we develop real estate, we consider the needs of today’s society and take into account the concerns of future generations. Social. Resource-saving. And with a strong sense of responsibility.

When buildings are created, value is created. By craftspeople who know their trade. With a convincing design and the use of the right materials. Construction sites are complex and constantly present us with new challenges. We master these with an agile mindset, professional project management and digital tools.

We own a large portfolio of high-quality properties. A good relationship and long-term partnerships with our key customers, the tenants, are important to us. We carefully develop our properties and renovate them in line with changing needs. This allows us to preserve their value and ensure stable returns.

Our strategy

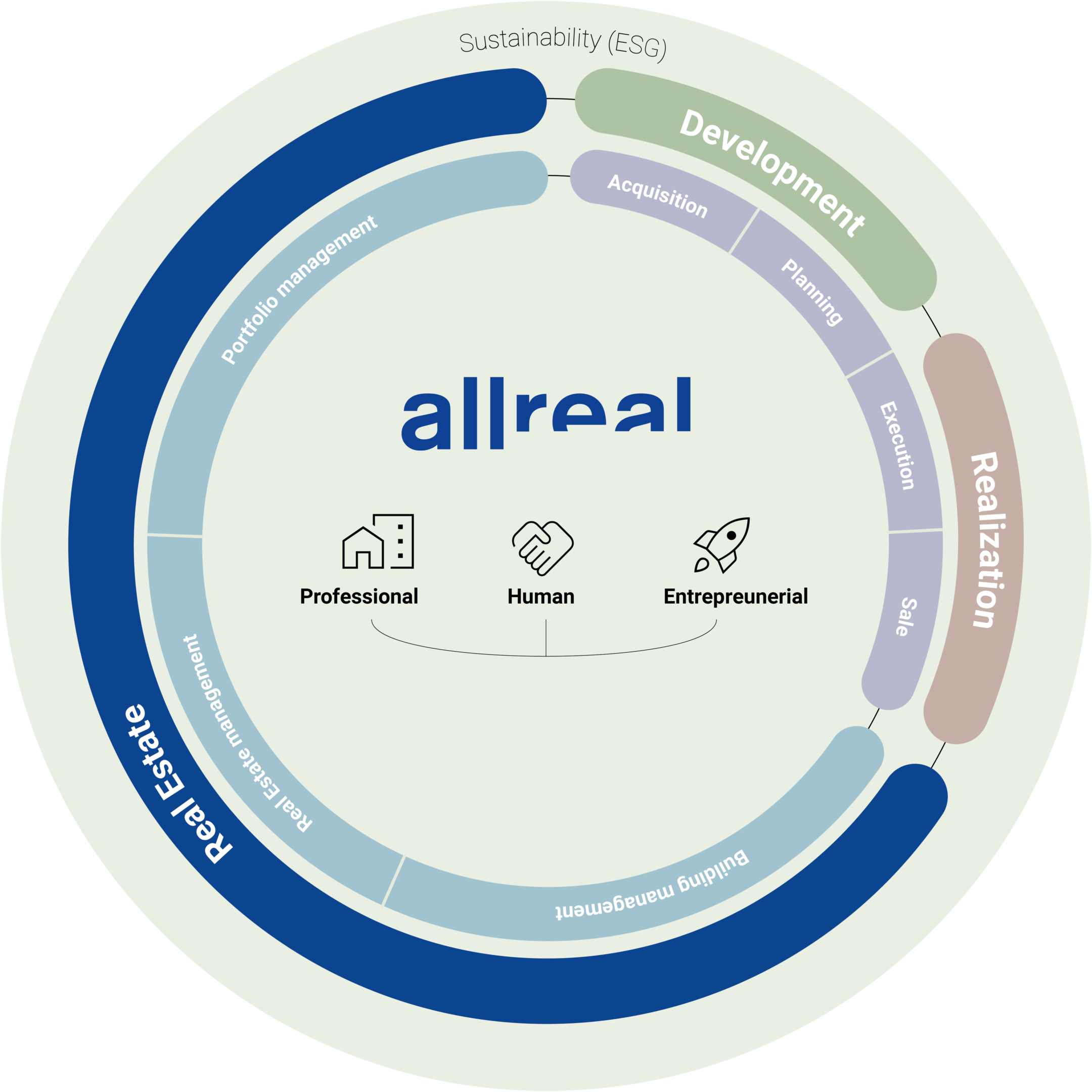

Our carefully managed portfolio of high-quality properties enables a secure investment with stable returns. Complemented by our development and realisation expertise, this results in added value and growth. By integrating our expertise, we understand real estate along the entire value chain.

As developers, we buy land, individual properties, entire portfolios or development sites and realise high-quality, sustainable properties on them. We define development and marketing strategies and ensure professional planning and construction. By digitally mapping what is being built physically, we can respond to changing needs in an agile and efficient manner and also transfer the right data along with the building.

In our own portfolio, we have high-quality commercial properties in urban transport centres as well as larger residential properties in the metropolitan regions of Zurich and Lake Geneva . We manage our portfolio ourselves and continuously optimise the earnings and costs of our investment properties. Through active management and our own technical expertise, we ensure that our properties are carefully maintained and continuously renovated.

The integration of the three divisions Real Estate, Development and Realisation under one roof allows us to take an agile approach without complicated contracts and interfaces. The solid economic basis of the portfolio enables long-term thinking in project development. The early involvement of construction expertise in the project development ensures efficient and high-quality implementation. The construction and development expertise, in turn, helps to create the best possible value for the portfolio.

In addition to developing its own portfolio and selling condominiums, the development team also works on behalf of third parties who benefit from the Group’s comprehensive expertise. Third-party projects in realisation increase our competitiveness and contribute to stable utilization of the necessary capacities. Strict risk management and careful consideration of opportunities and risks are essential for this.

In all our activities, we are aware of the tension between economic, ecological and societal requirements and carefully weigh up the various aspects in the interests of sustainability.

Our values

Our values shape our culture and guide our behaviour. They reflect our standards and the way we treat each other. And stand for an attitude that constitutes our shared success.