Since 2000, the shares of Allreal Holding Ltd have been listed on SIX Swiss Exchange.

Currently, the Group’s share capital consists of 16,592,821 shares with a nominal value of CHF 1.00.

With a free float of 100% and an average trading volume of well over 20,000 shares per day, the securities are highly liquid.

As a real estate company, we cover the entire property value chain. Complemented by our development and realisation expertise, this results in added value and growth.

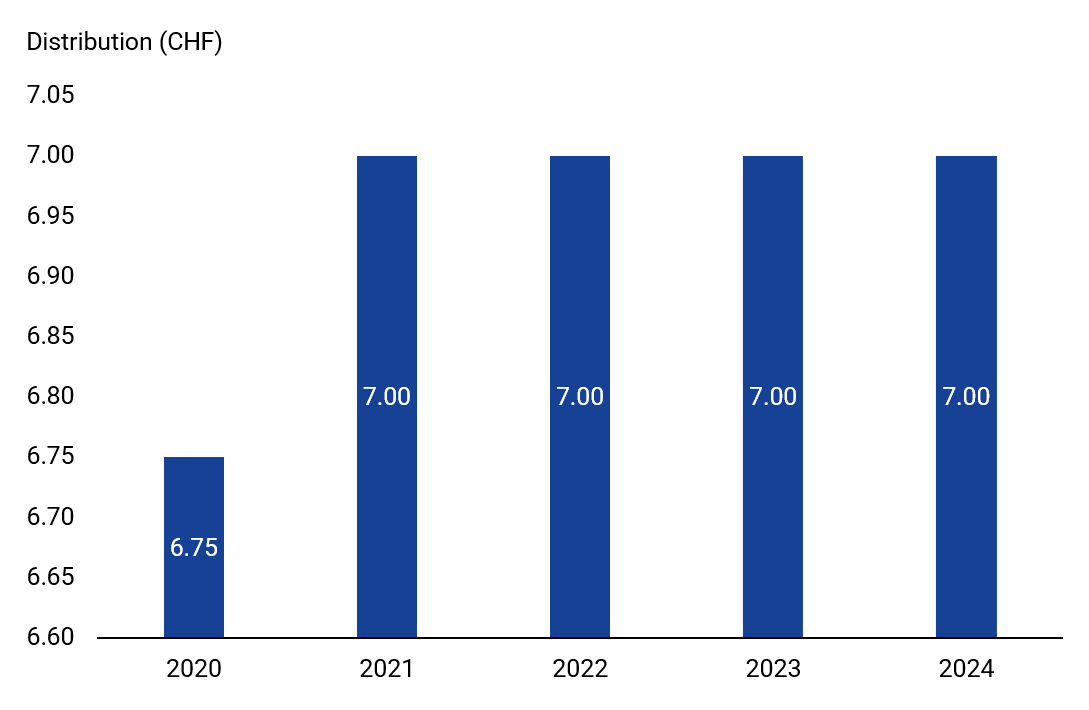

The stable dividend of recent years shows that Allreal has a predictable dividend policy.

In our own portfolio, we have high-quality commercial properties in locations with excellent transport links as well as larger residential properties in the metropolitan regions of Zurich and Lake Geneva. These form a solid economic basis for long-term thinking in project development. The early involvement of construction expertise in the project development process ensures efficient and high-quality implementation. The construction and development expertise, in turn, helps to create the best possible value for the portfolio, thus ensuring reliable dividends.

Information policy

Allreal publishes a financial report in German and English twice a year and an externally audited sustainability report in accordance with GRI standards once a year. The reports are only issued in digital format.

The company provides comprehensive and timely information on important business events and relevant project milestones.